Navigating the Waves: How Interest Rates Affect Property Investment

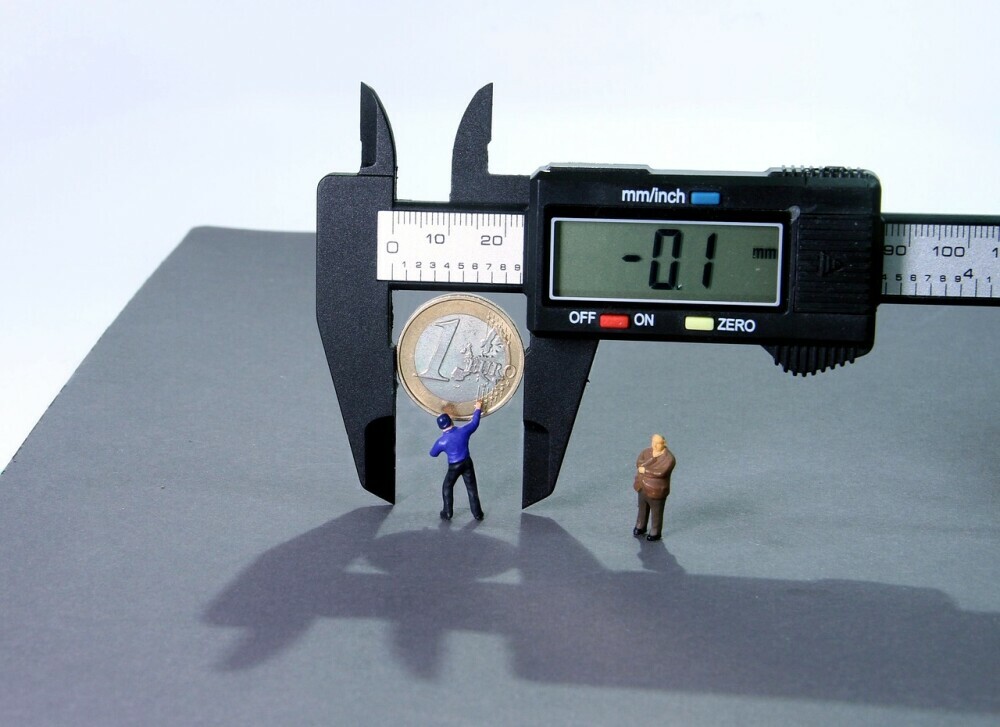

Interest rates are like the tides of the property investment ocean. They can significantly impact the landscape, influencing everything from property values to your overall investment strategy. Understanding this relationship is crucial for any savvy investor.

Setting the Stage: Interest Rates and the Economy

Interest rates are essentially the cost of borrowing money. Central banks determine these rates to influence economic activity. Lower rates generally stimulate borrowing and spending, boosting the economy. Conversely, higher rates discourage borrowing and slow things down.

Inflation’s Role in the Interest Rate Equation

A key factor affecting interest rates is inflation, the rising cost of goods and services. Central banks raise rates to combat inflation by making borrowing more expensive, thereby decreasing demand and curbing price increases.

Interest Rates and the Property Market: A Balancing Act

Now, let’s dive into the property market. Lower interest rates make mortgages cheaper, increasing buyer demand and potentially driving up property prices. Conversely, higher rates make mortgages more expensive, reducing buyer demand and potentially leading to price stagnation or even a decline.

Investor Considerations: Renting vs. Buying

For property investors, interest rates influence the choice between buying and renting. When rates are low, buying becomes more attractive due to lower mortgage costs and potentially rising rental yields. However, higher interest rates can squeeze profit margins for buy-to-let investors, making renting a more viable option.

Investing in a Sea of Change: Strategies for High Interest Rates

So, what can you do as an investor when interest rates rise? Here are a few strategies:

- Mitigate Risk: Diversify your portfolio across different property types and locations to spread risk. Consider fixed-rate mortgages to lock in lower rates for a set period.

- Timing is Key: Market research and economic forecasts can help you decide when to enter or exit the market based on anticipated interest rate changes.

Charting Your Course: Looking Ahead and Planning

Predicting interest rate movements can be challenging, but you can utilize economic indicators and expert insights to make informed decisions. Building a resilient portfolio that can weather interest rate fluctuations is key to long-term success.

Investing for the Future: Expert Guidance is Your Anchor

Remember, navigating the complexities of the property market requires knowledge and experience. Don’t hesitate to seek out the advice of qualified financial advisors and property professionals to help you make sound investment decisions, even amidst fluctuating interest rates.

By understanding the impact of interest rates and implementing these strategies, you can make informed investment choices and navigate the ever-changing tides of the property market.

If you would like to discuss the financing or funding of any project do not hesitate to Call Alan on 07539141257 or 03332241257, or +447539141257 or +443332241257, you can schedule a call with Alan on https://calendly .com/alanje or drop an email to alan@alpusgroup.com.