The Ultimate Guide to Tax-Efficient Asset Sales with Alpus

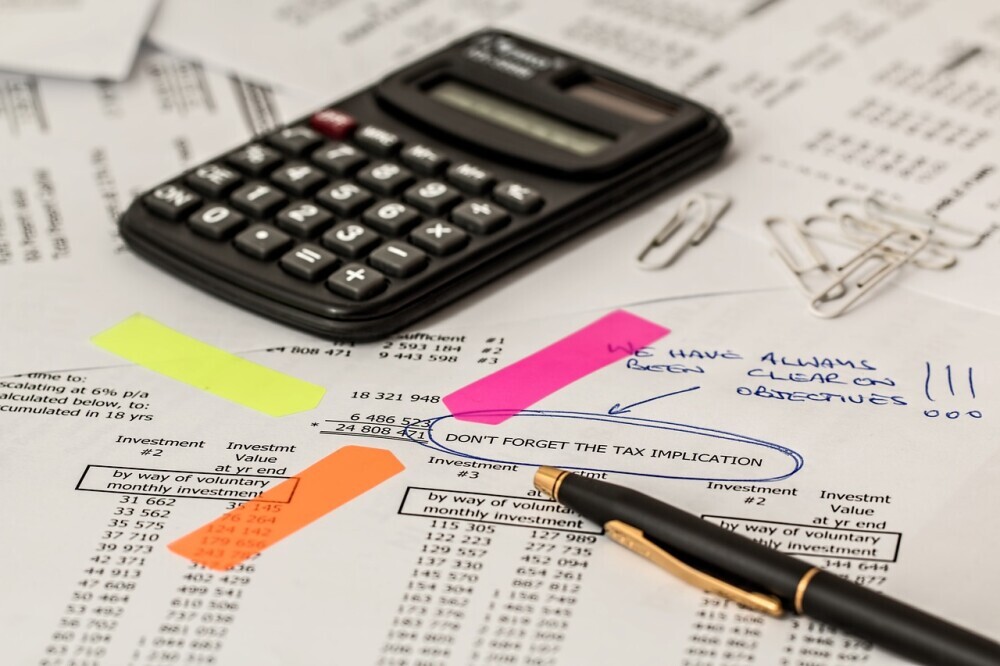

Understanding Tax-Efficient Asset Sales

When you sell an asset, whether it’s a property, stocks, or collectibles, you may be subject to capital gains tax. This tax can significantly reduce your overall returns. A tax-efficient asset sale involves strategically planning and executing your sale to minimize your tax liability.

Key Principles and Practices

- Timing: Selling assets at the right time can make a significant difference in your tax burden. Consider factors like your income level, the holding period of the asset, and the current tax laws.

- Tax shelters: Utilizing tax shelters, such as retirement accounts or charitable contributions, can help reduce your taxable income.

- Capital gains tax: Understand the different tax rates for short-term and long-term capital gains. Long-term gains typically have lower tax rates.

- Tax loss harvesting: Selling assets at a loss to offset capital gains can help reduce your overall tax liability.

Why It Matters for Investors

Maximizing your returns is a primary goal for any investor. By understanding and implementing tax-efficient strategies, you can significantly increase your overall wealth.

Alpus: Who We Are and Our Expertise

Alpus is a leading financial advisory firm specializing in tax-efficient asset sales. Our team of experienced professionals provides personalized guidance and tailored solutions to help you optimize your financial outcomes.

Strategies for Tax-Efficient Asset Sales

- Timing Your Sales for Maximum Benefit: Our experts will analyze your financial situation and identify the optimal time to sell your assets to minimize your tax liability.

- Utilizing Tax Shelters and Deferrals: We’ll explore opportunities to defer or reduce your capital gains tax through tax shelters like retirement accounts or charitable contributions.

- The Role of Capital Gains Tax in Asset Sales: Our team will provide in-depth knowledge of capital gains tax laws and their implications for your specific situation.

- Strategies for Minimizing Tax Liability: We’ll develop customized strategies to help you minimize your tax burden, such as tax loss harvesting and charitable deductions.

Leveraging Alpus’s Tools and Services

- Comprehensive Financial Analysis: Our team will conduct a thorough analysis of your financial situation to identify potential tax savings opportunities.

- Personalized Tax Planning: We’ll develop a tailored tax plan that aligns with your financial goals and risk tolerance.

- Ongoing Monitoring and Support: Alpus will provide ongoing support and guidance to ensure your tax strategy remains effective over time.

Case Studies: Real-World Applications

- Successful Tax-Efficient Asset Sales with Alpus: Learn about our clients’ experiences and how Alpus helped them achieve significant tax savings.

- Lessons Learned from Client Experiences: Discover valuable insights and best practices from real-world examples.

- Before and After: The Impact of Tax-Efficient Strategies: See how our clients’ financial situations improved after implementing tax-efficient strategies.

Diverse Asset Types and Unique Approaches

- Real Estate: Learn about strategies for selling properties while minimizing capital gains tax.

- Stocks and Bonds: Discover techniques for optimizing tax implications when selling securities.

- Collectibles and Other Assets: Understand the unique tax considerations for different types of assets.

Client Testimonials and Their Success Stories

Hear directly from our clients about their experiences working with Alpus and the positive impact on their financial outcomes.

Getting Started with Alpus

- Initial Consultation and Assessment: Schedule a free consultation to discuss your financial goals and challenges.

- Customized Plans and Solutions: Our team will develop a personalized plan tailored to your specific needs.

- Step-by-Step Guidance and Support: We’ll provide ongoing support throughout the entire process.

- Monitoring and Adjusting Your Strategy Over Time: Alpus will regularly review your strategy and make adjustments as needed to ensure it remains effective.

How to Reach Out and Begin Your Journey

Contact Alpus today to schedule a consultation and start exploring how we can help you achieve tax-efficient asset sales.

If you would like to discuss the tax efficient sale of your property, do not hesitate to Call Alan on 07539141257 or 03332241257, or +447539141257 or +443332241257, you can schedule a call with Alan on https://calendly .com/alanje or drop an email to alan@alpusgroup.com.